First, DataQuick has an interesting quote in the article accompanying this data:

“The median age of the home loans that went into default last quarter was 14 months, and more than half were originated in 2005.”

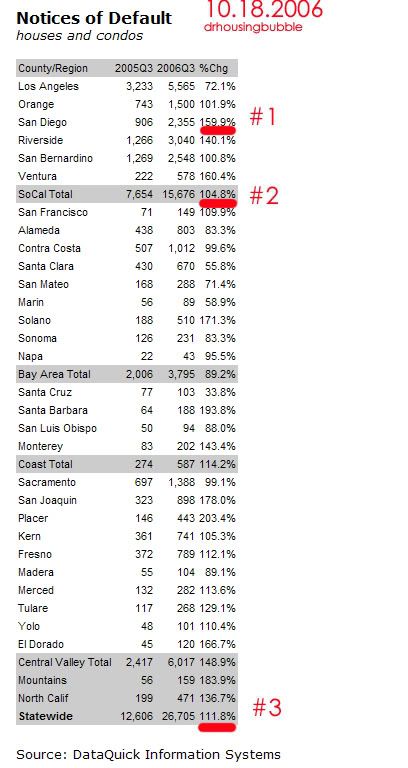

More than half of the loans that are currently in the foreclosure stage were originated in 2005. In addition, the median age of loans in default is only 14 months. 14 months! Think home owners did a Gumby and overstretched themselves? Let us dive into three key points from the chart:

1. San Diego is getting hammered. Foreclosures are up 159.9% from the third quarter in 2005. Didn’t get that? San Diego is facing foreclosures up in the 160% range. In raw number terms we have 2,355 homes facing foreclosure where last year we only had 906. Let us run a hypothetical from the article. The average California home foreclosure was 5 months behind ($9,829) with a median mortgage of $306,000. Let us do the numbers above shall we?

2005 3rd Quarter = (906)x($306,000) = $277,236,000

2006 3rd Quarter = (2,355) x ($306,000) = $720,630,000

Even at a low number, many housing head pundits say that the difference between 906 and 2,355 is negligible. Do you think half a billion dollars only in the San Diego area now at risk is negligible?

2. Southern California is up 104.8% in foreclosures. So you are telling me that this isn’t isolated? Nope. This is statewide. Where last year the canary in the mine San Diego was facing pain, now all of Southern California is facing an increasing number of foreclosures. And we are talking a dramatic change.

3. Statewide California is seeing a jump of 111.8% in foreclosures. How this isn’t big news boggles the mind. We currently have 26,705 homes facing foreclosure. Of course there are many stages to foreclosure as listed below:

But the difference now in 2006 as opposed to 2005 is:

• We are in a falling market

• By looking at the data, half of these loans originated during or post 2005. So much for having years and years of equity like many claim.

• Less buyers are in the market

• Many adjustable mortgages are, well adjusting (big surprise)

• Market sentiment is drastically changing

• An X factor as well. Many folks took out HELOC and home loans that have much higher rates. Equity is at all time lows even though appreciation has ramped up to all time highs. An oxymoron yes but foreclosures are through the roof. Like I discussed in a previous post, equity isn’t yours until the certified check is in your hands after escrow is closed!

The market is changing day by day. Fall and winter are slow selling and buying seasons. I’m thinking the big show will be spring and summer of 2007 when many sellers think they will be able to unload their homes at peak prices. Unfortunately like the five year old learning there is no Santa Clause, they will find out the equity bunny is nowhere to be found.

Digg This!

Digg This! Add to Reddit!

Add to Reddit! Save to del.icio.us!

Save to del.icio.us!

12 Comments:

I just read your comments on Marin Housing Bubble. I must say that you do good work and I like your blog for it. It matters not to me what our various views are, I appreciate the fact that you take the time to create insightful articles.

Btw, don't get fooled by the high % increases in foreclosures when compared to 2005. What would you expect to find in a year (2006) following a year when prices went up (2005) and people could sell prior to foreclosure?

Thanks Larry. If anything, I hope readers on this blog can voice their opinion on both sides of the coin. Clearly my position is that we are in a housing bubble fueled by speculation, easy financing, and a general sense of market sentiment favoring real estate. I want this blog to provide evidence as to why there is a bubble and provide insight into the numbers and what the mainstream media is pumping out.

By the way, I enjoy your blog and think you have valid things to say about creating wealth. Real estate is part of any well-balanced portfolio. But I am of the camp that you make money WHEN you buy real estate and at what price. And currently I would not recommend buying in Southern California.

I welcome both sides of the debate on this blog.

Ok. But, you can't use "real estate" and "housing" interchangably.

It's as important a point as saying that Southern California housing market is bad for Chicago suburb homeowners....

Larry:

We have already discussed this issue before. Let me give you a few headlines:

The Housing Bubble Fact Sheet

www.cepr.net/publications/housing_fact_2005_07.pdf

Housing Bubble -- or Bunk?

www.businessweek.com/bwdaily/dnflash/jun2005/nf20050622_9404_db008.htm

Buffett and Munger warn of real estate 'bubble' - May. 2, 2005

http://money.cnn.com/2005/05/01/news/fortune500/buffett_talks/?cnn=yes

Real Estate Bubble? You Bet! [Fool.com: Commentary] October 26, 2005

www.fool.com/news/commentary/2005/commentary05102606.htm

Now who are these sources and why are they using “housing” and “real estate” interchangeably when addressing the bubble? These sources are part of the mainstream media and come from sources such as:

Center for Education and Policy Research

Businessweek

CNN – Money Magazine

Fool.com

Think they don’t understand the difference Larry? Again you resort to straw man arguments using a ridiculous comparison. You think the average person is not going to know the difference if I say:

“We are in a housing bubble.”

“We are in a real estate bubble.”

Come on, the media has used these interchangeably because the connotation now means the same. A real estate agent sells housing; but he isn’t call a housing agent. But 90 percent of all agents only focus on residential housing including condos. Think this is confusing? Your example of Southern California housing will have an impact in Chicago is laughable if not grasping at straws. Are you trying to argue semantics here? Again, go refer to more credit worthy sources such as CNN and Businessweek and enlighten them on the difference.

According to Merriam-Webster the definitions are as follows:

Real estate: property in buildings and land

Housing: to provide with living quarters or shelter.

So real estate includes raw land, condos, housing, commercial property, duplexes, apartments, etc. Housing merely provides shelter. Again, you are arguing semantics and I encourage you to do a Google Trends search and type in “housing bubble” and “real estate bubble.” You think the public makes a distinction? The data shows otherwise. If you want to make a case for being a housing bull please use data to back up your argument. Most readers are going to see that the only thing you can poke holes at are definitions that really detract from the economic reality that housing is overpriced, inventories are rising, prices are trending downward, and exotic financing is rampant. Risk management has been tossed to the wind.

Here is a source for tracking foreclosure trends:

[Link]

In San Diego, both commercial and residential real estate markets are eating dirt, so I think that it is safe to say that the 'real estate' bubble for San Diego is bursting right in front of my eyes.

Think that Phoenix real estate market is also not bursting? Think again..

"County Info

Maricopa

Foreclosures: 877

Preforeclosures: 6,933

Bankruptcies: 2,272

FSBOs: 502

Tax Liens: 25,442 "

[Link]

as compared to San Diego County:

"County Info

San Diego

Foreclosures: 925

Preforeclosures: 5,539

Bankruptcies: 1,750

FSBOs: 133

Tax Liens: 19,378 "

[Link]

IN REAL TIME!

"Think that Phoenix real estate market is also not bursting? Think again.."

IT'S NOT AT THIS MOMENT. I WON'T PREDICT THE FUTURE, BUT RIGHT NOW, ACCORDING TO THE AZ REPUBLIC (from Sunday) PRICES HAVE MOVED UP QUITE A BIT IN MOST COUNTY ZIP CODES.

And, those foreclosure numbers here reflect a county/city of almost 3,600,000 (6th largest in the US)

Dr.: It does not surprise me that the media his headline driven.

remember this saying: "If it bleeds, it leads".

from the Arizona Republic, reports that despite slumping sales activity, the West Valley's median price for houses rose during the first eight months of 2006, anywhere from 10 to 30 percent, according to an analysis by the Arizona Republic

http://www.azcentral.com/php-bin/clicktrack/print.php?referer=http://www.azcentral.com/community/westvalley/articles/1020gl-homevalues20Z20.html

Now who are these sources and why are they using “housing” and “real estate” interchangeably when addressing the bubble?

READ THEM, THEY AREN'T.

Buffet:

"A lot of the psychological well being of the American public comes from how well they've done with their house over the years. If indeed there's been a bubble, and it's pricked at some point, the net effect on Berkshire might well be positive [because the company's financial strength would allow it to buy real-estate-related businesses at bargain prices]....

Larry,

You are, quite possibly the biggest turd in the entire internet.

You should get a medal for that. It takes a lot of guts to handle the kind of SH*T you're shoveling.

IT'S NOT AT THIS MOMENT. I WON'T PREDICT THE FUTURE, BUT RIGHT NOW, ACCORDING TO THE AZ REPUBLIC (from Sunday) PRICES HAVE MOVED UP QUITE A BIT IN MOST COUNTY ZIP CODES.

Well, according to this housing tracker that tracks inventory and the median 'asking price', Phoenix is already down 9.2% (Year over Year).

[Link]

I can not see how the numbers from the Arizona Republic are going to be more accurate and timely than the inventory and pricing numbers from the MLS.

...

County Info

Maricopa

Foreclosures: 911

Preforeclosures: 7,302

Bankruptcies: 2,233

FSBOs: 491

Tax Liens: 25,442

It looks like the number of foreclosures for Phoenix are increasing on a daily basis.

What do you think?

Post a Comment