Yee-Haw!!! Wow, talk about a major jump in foreclosures. We did mention this would happen a few times but hey, what do we know right?

Foreclosures and Housing Bubble

When will my home cost me an ARM and leg?

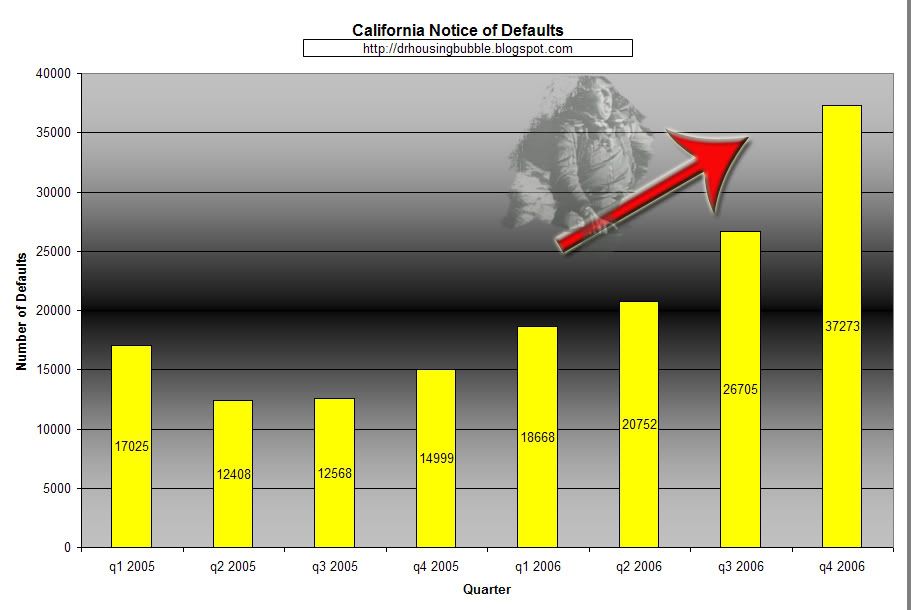

There are many graphs out there showing that foreclosures are at 10 year highs but I wanted to post a graph showing the last eight quarters for California. Again, sounding like a broken record, we knew this would happen with rates resetting, inventory increasing, and prices declining. Even worse, a stagnant market does nothing for current sellers because the sub-prime market has attached a bomb to each home that will go off in one, two, or even three years. Each neighborhood has these sub-prime bombs; maybe even you are one of these and don't even know it??? Why the major jump last quarter?

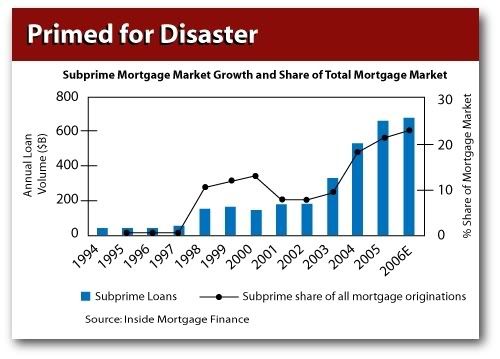

As you can see from above, we are at the peak of resetting season. The Mortgage Bankers Association estimates that $1 trillion in loans will reset this year. You may ask, “Dr. Housing Bubble, mortgages reset last year and we didn’t see such a drastic jump, why was this?” Well my dear readers, this is called selling to the last fool. Not only that, but the buck has been passed around so many times that we have a hard time seeing who is the initial culprit. In 2005 and 2006 25% of all mortgage originations were in the sub-prime market. Currently we are seeing the 2003 and 2004 resets hit the market:

So ask yourself, if mortgage defaults jumped this much in a market that is slightly declining what will happen when the 2005 resets occur later this year?

“Oh boy! Do we got some stories to tell!”

And remember folks, we are just starting to see REOs hit the market in significant numbers so you can only guess what this will do to the median price. This takes time as you can see below:

We are in for a lot of action in 2007 and I like to welcome you to California’s Gold Housing Market!

Digg This!

Digg This! Add to Reddit!

Add to Reddit! Save to del.icio.us!

Save to del.icio.us!

17 Comments:

Wow... that foreclosure hockeystick looks strangely like the faux real estate can't lose bubble hockeystick of price increases for the past 5 years. ;-)

Good work here!

Athena:

Shhh…Don’t give out the secret! Going up means going down. Plus, we don't play hockey in SoCal. ;)

I think we should get used to this trend with foreclosures. Maybe this is the proverbial dead cat bounce? Bwhahaha! We need to listen to David Lereah for some common sense.

We don't play hockey up here in Northern California either. ;-)

And looks like those hockeysticks are about to turn into the paddles poised for the backsides of the FBs who found them so fascinating just a short time ago.

Wonderful post! Seeing the visuals really makes a difference!

zovall:

Glad you liked the visuals. We're definitely in for a lot of action this year. Are any of you following the Casey Serin action unfold?

Well here is the 15 second run down:

Casey, a guy who is 2.2 million in debt, posted a contract on his site yesterday from No Limit Ladies, a couple of RK followers.

The contract was no disclosure and essentially sold Casey’s soul to these so called ladies. Casey has [had] a lot of traffic to his website.

The ladies fired back at Casey’s host site, GatorHost, and they covered their arse and pulled his site down including ablebuyer.com yesterday.

Casey has a new mentor which told him to put the contract up. Next, we see http://www.nolimitsladies.com/ go down to China Town.

Blog wars at their best. Let the rodents feed off one another. When the money runs out fingers start pointing everywhere.

Dr. H

And, if you think it's just going to happen here because of our high prices - read on:

http://abcnews.go.com/Business/Housing/story?id=2823301&page=1

anon:

High price or low prices, if someone can't make the payment they'll lose their home. Here is a quote from the article:

"The moral of the story is if money is too cheap, if we make it too easy, it can get ugly, especially for first-time home buyers," says Revitte. "In our quest to give everyone a shot at the great American dream — which is home ownership — loan programs that made it easy, perhaps too easy created some very sad stories."

Thanks ABC for stating the absolute obvious. Easy money started with "Easy Al" dropping the Fed rates to near zero. Guess zero is close to cheap. But since he is now gone and his actions are only coming to fruition, most will associate blame to those currently holding the bag (i.e., mortgage brokers/lenders/dealers, agents, builders, sellers, etc).

Think of this, we're in the first month of the year and this is what we got:

©California Foreclosures up 100%+ over last year.

©Housing slump worst in nearly 20 years - Posted via CNN

©REOs hitting the market at a feverish pace

©Prices down, inventory up

©Rates resetting to the tune of $3 Billion A DAY

The endgame is quickly approaching. What is the net effect of this? To be frank, we cannot have an economy that is based on wheeling and dealing houses as our primary source of growth. The over compensation, speculation, and corruption is now breaking at its seams. Folks need to realize that for us to stay competitive in the global marketplace we need technology and an educated population. Engineers, physicists, doctors, lawyers, and visionaries. When someone can make $100,000 with a GED and a real estate license or working as a mortgage broker what is the incentive to come out as a civil engineer making $60,000?

If anything the upcoming housing correction should be seen as a values correction.

Regarding foreclosure timeline above: I saw a post in another forum that estimates 9 months for the REO process - if that's true we are looking at mid to late 2008 to reflect current 2007 problems? Although CrashLanders id'd some REOs where the bank made quick deals to stem losses - banks getting smarter?

Ask any of the doom & gloomers if they are hoping for a housing crash. Ask them if they want to see people get hurt financially. In fact, ask a housing bubble blog owner the purpose of their blog. I am quite sure they won't answer.

Fact is, people in their own lives and their own experiences have done extremely will in all sectors of real estate and will probably do just fine going out.

Let's take Phoenix, AZ: Maricopa county will double in size by 2030! Every school, home, gas station, Starbucks, dry cleaner in the valley will double its numbers in the next 15-25 years. Would anyone conclude therefore, that real estate is somehow doomed? Well, they'll say yes, in the short-term.

It's kinda of hard to make money in the stock market when the averages are going down. And, not too hard when the averages are going up. Not so in real estate. It simply doesn't matter what the median price increases are anywhere because it's so easy to beat those averages with just a hint of knowledge and sanity.

In fact, prices have appreciated here an average of 6.2% per year for 30 years. That's 31% compounded for that period of time with 20% down! And, that's just the average...no one would dare make the same claim in the stock market...

Forclosures should be way up. The numbers are being compared to a boom that started in 1997 and has see prices explode since. So, no one needed forclosure when they could just sell (and probably for a profit). So, with prices not going up selling to beat foreclosure doesn't work right now.....no surprise there.

Larry said:

“Ask any of the doom & gloomers if they are hoping for a housing crash. Ask them if they want to see people get hurt financially. In fact, ask a housing bubble blog owner the purpose of their blog. I am quite sure they won't answer.

Fact is, people in their own lives and their own experiences have done extremely will in all sectors of real estate and will probably do just fine going out.”

Not only “bubble bloggers” are looking forward to a housing slump but Montley Fool, The Economist, and the L.A. Times to name a few. But I digress. There was an article published in the L.A. Times today talking about the coming housing slump; in fact, they are looking forward to the housing slump. See Larry, most folks think it is ridiculous that only 15% of the local population can afford a home; in terms of your argument this is ALREADY financially hurting people. Do we want to see folks get financially hurt? Five years of appreciation culminating in 135% price growth with little support via wages is already causing the damage. If anything a housing bust will wipe out flippers, speculators, gouging builders, and we are currently starting to see the tip of the iceberg of mortgage fraud. Yes Larry, but these are things you find okay since as long as folks are making money who cares what the means are right?

Bring on the Housing Slump

Not only that, but there was a net migration out of Southern California the last few years of those folks with bachelor’s degrees; an exodus of the middle-class. You think an economy can support itself with only a few elite folks buying and trading homes all the way to the top? Probably not and that is why a housing decline is actually better for most middle-class families in this area.

So I think I answered your question directly and rather promptly. The purpose of this blog is to point out evidence of a housing bubble in Southern California. If folks want to go out and purchase a 2 bedroom 900 square foot home for $450,000 then that is their right; but fiscally mortgaging your life away and having a home eat up 50 to 60% of your monthly net income is not exactly smart.

The press has also given considerable coverage to the reluctance of consumers to spend money during what is perceived to be challenging economic times.

You can’t believe everything you read. The experts are often wrong.

Time Magazine reported, “The prices of houses seem to have reached a plateau, and there is reasonable expectancy that prices will decline.” They wrote that in 1947.

Business Week said, “The goal of owning a home seems to be getting beyond the reach of more and more Americans.” When they wrote that in 1969, the average price of a house was $28,000.

The Miami Herald wrote, “If you are looking to buy, be careful. Rising home values are not a sure thing anymore.” That sage advice came in 1985.

Money Magazine said, “Most economists agree . . .a home will become little more than a roof and a tax deduction, certainly not the lucrative investment it was .” That was their best advice in 1986.

"...for now, the frothy buying conditions in some of the nation's biggest housing markets, especially for high-end-homes, worry economists, who remember how the housing market crashed in the late 1980s after some markets overheated."The Wall Street Journal (bottom of page), March 6, 2000

Larry,

Great way to setup a straw man argument and distort the main argument. Again, your assertion that “ask a housing bubble blog owner the purpose of their blog. I am quite sure they won't answer”, sorry to say it but I just answered it above so that makes you wrong on that point. In addition, using cherry picked data from 1947, 1969, 1985, 1986, and 2000 only proves that your argument has one track. I can easily throw out arguments that go to the other extreme; remember the book Dow 30,000? What about David Lereah claiming that we hit bottom for the last three months in a row? Or the California Realtor Association predicting early last year that we were going to see single to double-digit appreciation in 2006? Experts can be wrong on both sides so try to be fair.

Your main view is that housing will go up in the long run. But what does long run mean? You assume that housing will go up on a 45-degree angle at all times. But how long would it take for you to recover if you placed all your money into the stock market in 1929, 1987, or 1995? The point is, there are certain peak moments when things get overpriced. What if it takes 10, 15, or 20 years for prices to level out? I doubt most home buyers want to take a hit for $100,000 or $200,000 just to win in the 20 year long run. Why not go back to the 80s and buy Microsoft, Dell, and Intel stock? Wouldn’t it make more sense to let the market correct for a few years and then purchase? If appreciation is either negative or zero there really isn’t the pressure of the last few years of missing out on 20% yearly gains and buying now.

I make no assumptions in either direction. My market (housing) has a bright outlook. But, people selling their own homes to live in a rental is very funny. It will only make apartment landlords even wealthier.

And, no, you didn't answer my main question despite thinking that you did.

Larry said:

“And, no, you didn't answer my main question despite thinking that you did.”

Let us try again to answer your question in direct format:

“Ask any of the doom & gloomers if they are hoping for a housing crash. Ask them if they want to see people get hurt financially. In fact, ask a housing bubble blog owner the purpose of their blog. I am quite sure they won't answer.”

1. Do I want to see folks get financially hurt? NO!

2. Do I want a housing correction? YES!

Can it be any clearer? Of course both of these questions do not support each other although you have it linked up in your mind that housing crash = financially hurt. The fact is, many people are already getting hurt financially. Even though prices are at all time highs equity in homes is at all time lows. Consumption does not equal financial health or security. I think most people that read housing blogs are not doom and gloomers; they have worked hard in whatever line of work they are following and want to provide the basic necessities for their family without leveraging their entire net paycheck on one line-item, that of housing. The fact that housing blogs have readers and supporters shows that there is a market of folks that have issues with the current state of housing. It is simple supply and demand; the media doesn’t pour over the details with charts and analysis so people go out and conduct their own due diligence. That is the beauty of the internet. Although I would argue that the mainstream media is taking the baton and carrying the fire of many housing bloggers.

You mention that the Phoenix market is healthy; if this is the case why not go out there and load up your portfolio with housing in Arizona since you believe housing will perpetually go up? The fact that Southern California has one of the lowest affordability in the nation is troublesome; even two-income families are struggling to keep up with the basics necessities of life. And yes, California has always been expensive but $400,000 to $450,000 for a 2 bedroom 900 square foot home in Lynwood or South Gate? Take a look at the “real homes of genius” category on this blog and then say California housing isn’t in a bubble. Low affordability means that only 15% of the local inhabitants can adequately afford a home. The direct correlation between rising home values and increased use of interest-only and exotic mortgages is nearly perfect. If rates are at 40 year lows, why would people go with mortgages that are highly risky and are not fixed?

From Curbed L.A. on 1/29/07:

A slowing market, another sales to rental switch-a-roo. Originally planned as a sales development, Villa Malibu has gone rental. Developed by the Carlyle Group, the gated luxury 68-unit community on Cavalleri Road opened for leasing earlier this month. The first luxury rental development in Malibu, rents range from $3,850 to $9,650 (for a few thousand dollars more, you can get a furnished pad), while the complex offers five-star amenities like include two tennis courts, pool, basketball court, concierge, private cabanas, and the obligatory Zen Garden. This summer, beach porter service will be available.

Can I get some of that stuff Larry is smokin'?

Post a Comment