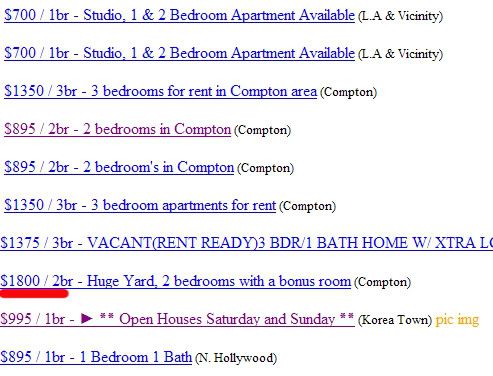

Sometimes you just have to laugh at the rampant speculation in Southern California. The above sample is just one of thousands of overpriced homes in Southern California that have benefited simply by being in the Golden State. Forget simple rules such as quality of area, good schools, and growing neighborhoods we are living in a new paradigm! So what if Southern California spans 200 miles to the east and 200 miles to the south, as long as you are in this bull’s-eye you are a champion. Even better if you are in Los Angeles County, Orange County, or San Diego County. It is a thing to witness this unbelievable bubble. If you run a simple query about how much this home would rent for in the area you get the following:

I’ve highlighted the obvious outlier here because this is probably someone that purchased at the top and is trying to recoup some money via renting. As you can see though, this house would probably rent for $1,100 to $1,300 a month. Let us put on our housing math hats and run the numbers for a second. We will assume that someone will buy this place for $450,000 with 20 percent down:

20 percent down = $90,000

PITI on $360,000 at 6.25% = $2,216

Taxes at 1% = $375 a month

Total monthly caring cost =$2,591

Even after tax savings this is way off base by over $1,000 a month; a spread ratio of over 100 percent! Given that owning a home will always cost more than buying but there are many places in the U.S. where you can purchase a home in a metro area for $125,000 to $150,000 and rent it out for $1,250 a month.

Another case example of the true Real Genius of Housing. We salute you Compton for making us proud via voodoo finance math.

Digg This!

Digg This! Add to Reddit!

Add to Reddit! Save to del.icio.us!

Save to del.icio.us!

12 Comments:

THANK YOU! I've seen lots of blogs covering the high end of the housing bubble but you really get some perspective when you point out that shacks in the ghetto are half a million. When that happened in SD, I almost completely lost hope of owning a home, but then I got schooled, and now I'm patiently waiting for prices to correct.

Dr. Bubble,

Can someone run an analysis on the spectrum of colors for exterior house paint and the correlation to value? When I retire i will publish my photographic essay on the savage landscape that is SoCal real estate. There are a few Laker houses up that way. Gold house , purple trim - nice!

Anon:

You are welcome. I mean nothing against certain areas but at these values you got to be kidding. It purely a bubble. Reminds me of the "programmers" that only could code basic HTML in 1998 and were earning $40,000 a year with a G.E.D.

San Diego is coming down so just be patient and find a deal that meets your needs in the next couple of years.

Dr. H

socalappraiser:

That is great! Maybe you can sell your idea to Zillow as a new feature. You can then sort homes by the color you like; maybe even sort by the number of garbage cans on the lawn.

Dr. H

You nailed it!! Your blog is great. Its California we have to watch, this state will lead all the bubble markets down. I am amazed with who keeps buying these overpriced 2 bedroom 1 bath homes that are 996 sq. ft for $730,000. (eg. in culver city, Hawthorne, Torrance)

But it comes down jobs. so lets see what California jobs and housing brings us for 07'.

Mozo:

You probably could have gotten a bit more considering how much credit has been pumped into the system.

The good thing in certain area prices are already off their 2005 peaks (i.e., San Diego) and we are in stage one of the housing slow down. In my opinion, this is the first true start of the multi-year housing bear market.

Take a look at the housing cycle history on my site and you can follow prices back to the 1800s.

Dr. H

Compton as in "GANGSTAAAAAAAA!" (BLAM! BLAM! BLAM! BLAM! BLAM!)?

Who's paying those prices? Pimps? Crack dealers? Gangsta Rappas?

anon:

Your guess is as good as mine. But I’m thinking this is a prime area for mortgage fraud. From the stats, you are probably getting a high percentage of no-doc folks coming in with teaser rates that have no idea what they have signed. The real estate syndicate is trying to push housing as much as it can and this is the only way, through the sub-prime market. Investors aren’t buying these homes because they wouldn’t rent and be negative cash-flowing all day long. So I’m thinking your guess may be relatively close to the truth.

http://sandiego.craigslist.org/rfs/263702031

.html

Encanto/Southeast SD is our Compton. When I saw it, I thought of you! Actually, if I had to guess, that foreclosure price pre-dates 2004 prices, and although I'm sure they'd throw in the spare tire, I think I'll continue to wait nonetheless :)

Anon:

The link didn't work but I know the area. What can I say? We are in the middle of a major bubble.

CNN came out with a cover story regarding the large jump in foreclosures for December. We didn't see that coming now did we?

Dr. H

You know, I know nothing about California, but in all of the hip hop that I listened to homes in Compton seem like they would be priced around $50k like they are in my market

Dear DHB.

OMG I love your blogs. I thought that compton homes were extremley funny, being that I was raised in south central, which is about the same. I could not believe what I was reading. Someone has a big heart ache comming(LOL)

Wow if you think that is something you should try North Fontana prices and Rancho Cucamonga. They have lost their minds

I will make sure to tell has many people as I can about your blog.

California needs to step back into reality!!

Post a Comment